Solutions

© 2025 Discover.Market, LLC

Solutions

© 2025 Discover.Market, LLC

© 2025 Discover.Market, LLC

Know what pays. Double down on it.

Your analytics tie Market activity to real revenue—live feed, product popularity, regional heat, and rep

territory performance.

Pipeline created

$847K

Quotes & order intents from tracked activity

Time to first order

18 days

From first interaction to first purchase

Repeat order rate

68%

% of accounts placing 2+ orders

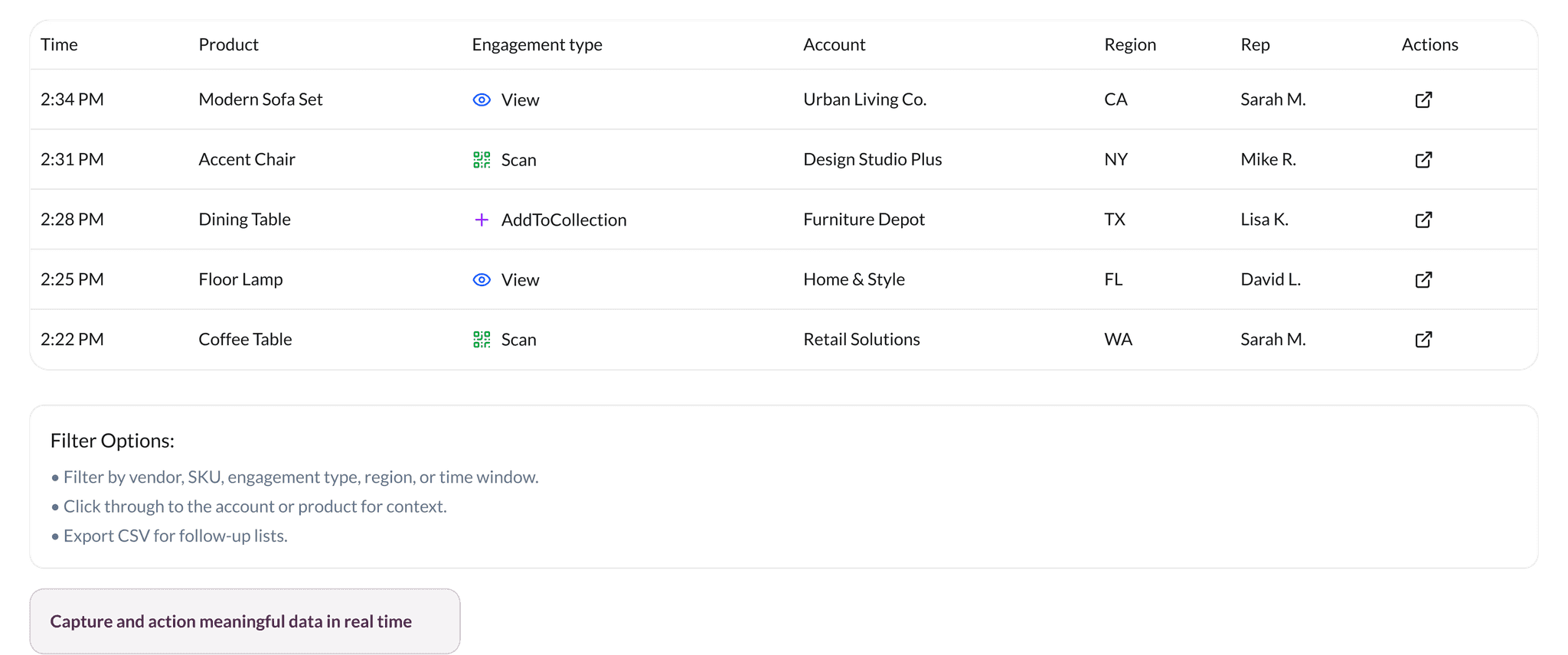

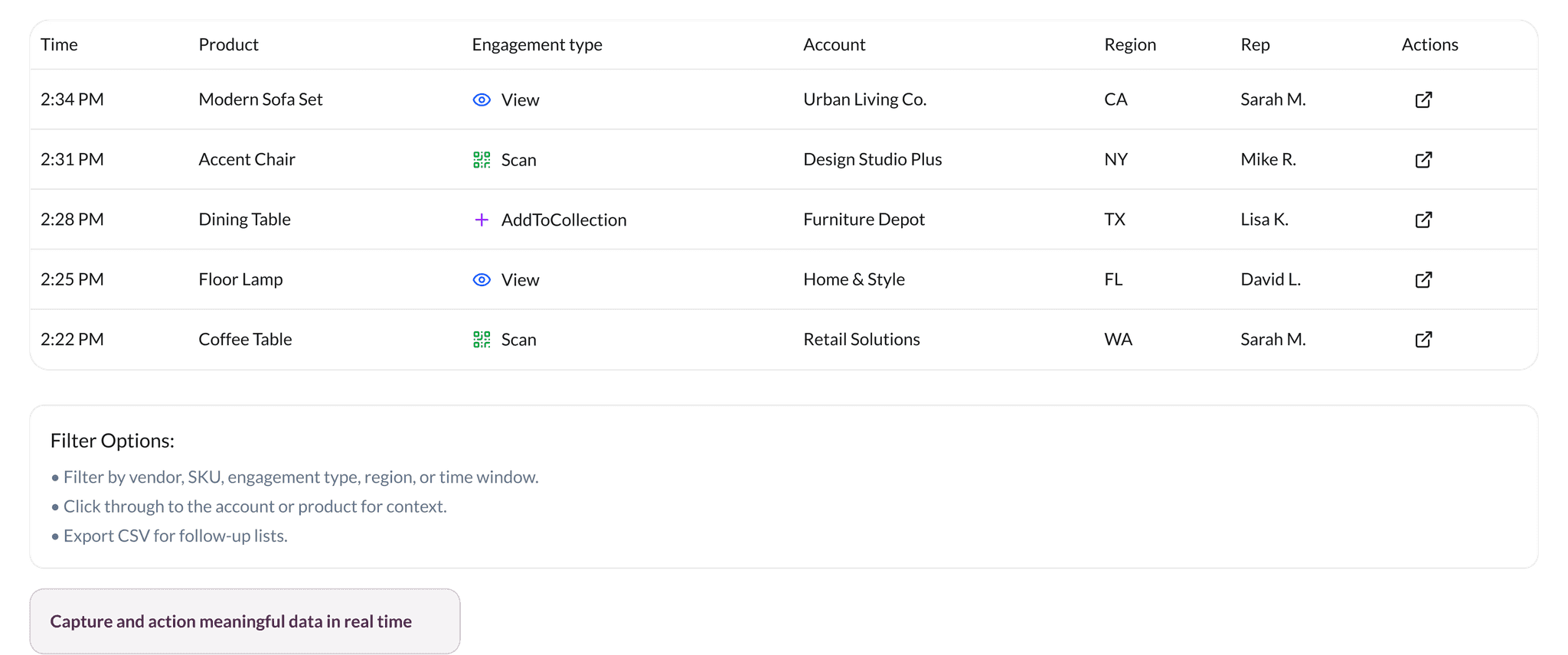

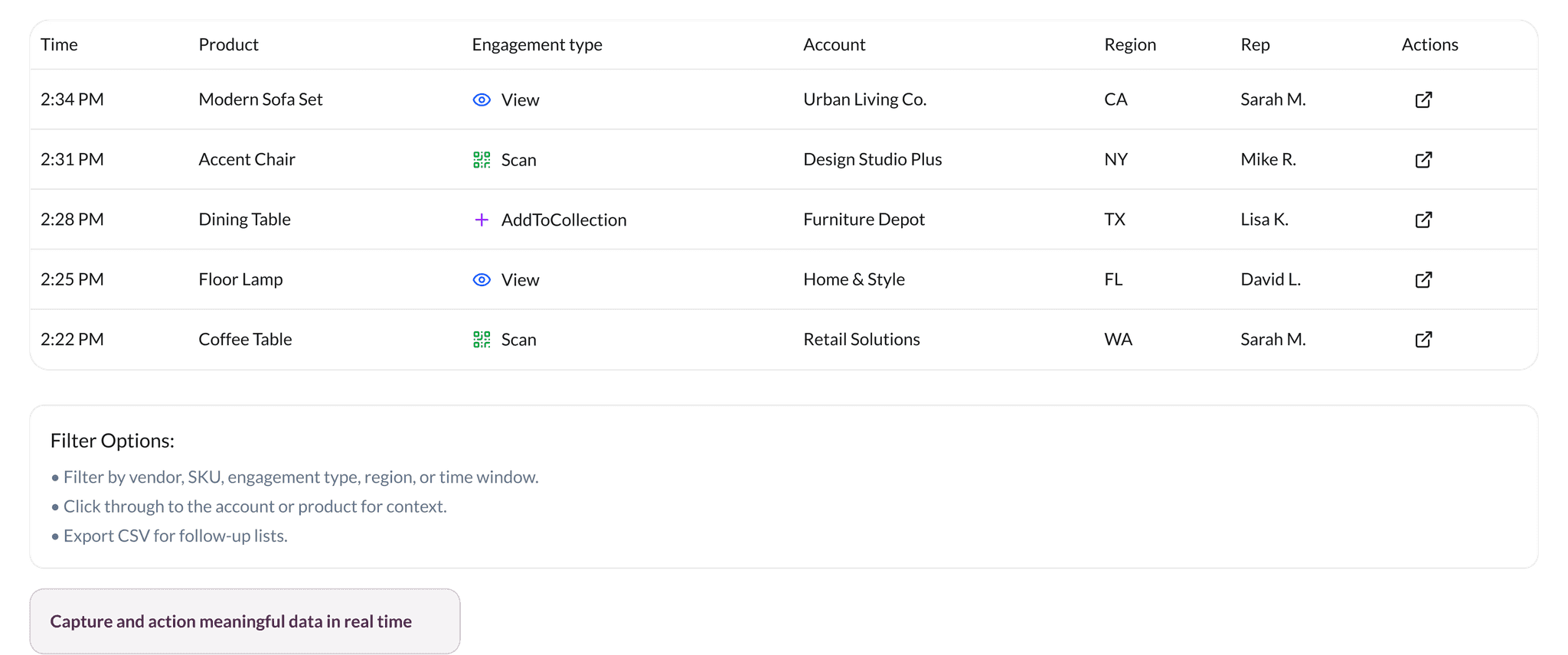

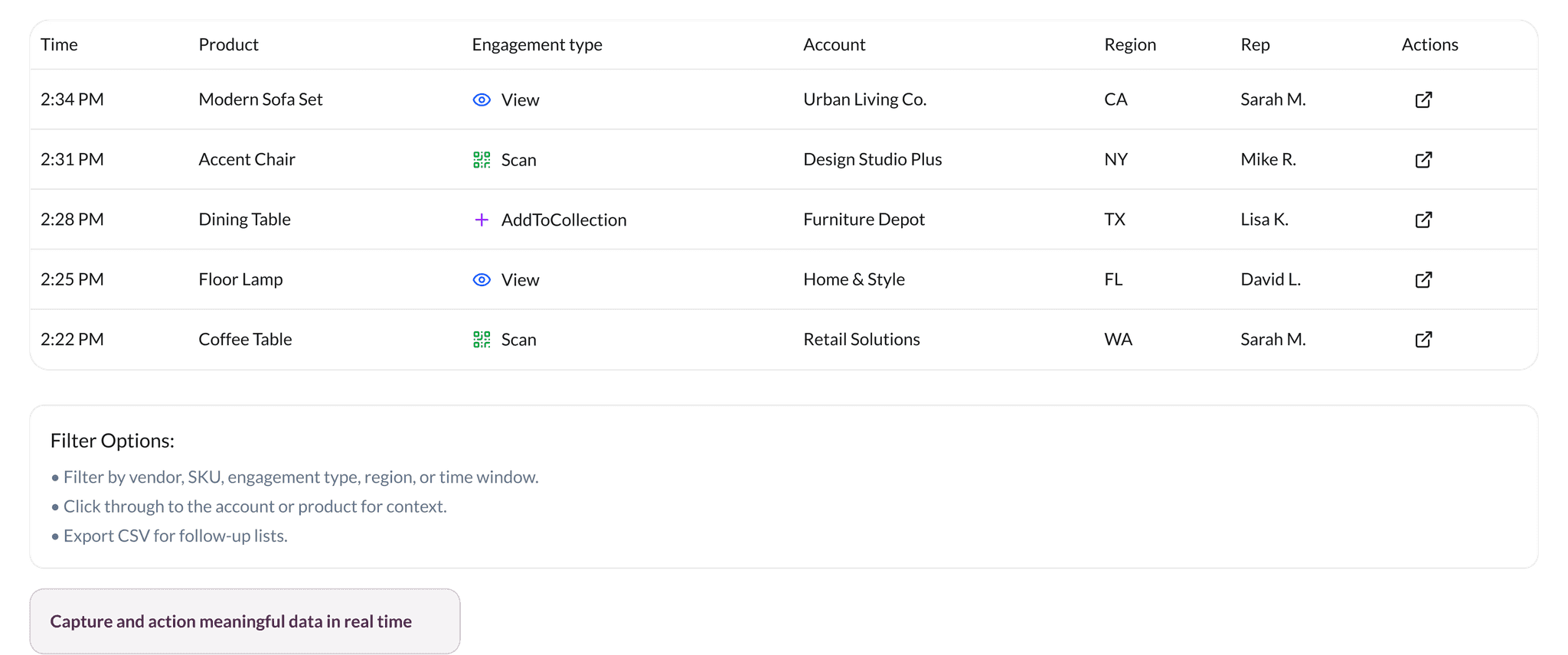

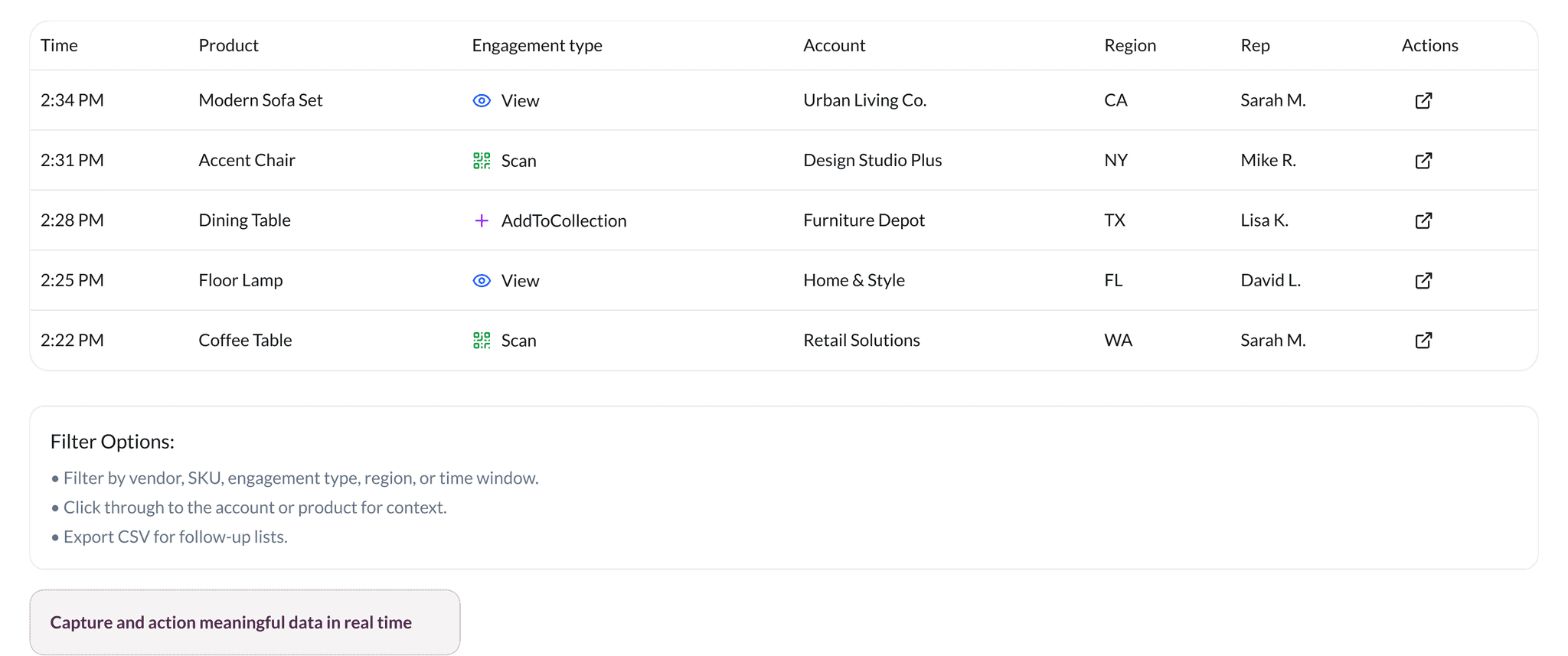

Live activity feed

Every interaction in one stream: product views, QR scans, and "add to collection" events across all end-users.

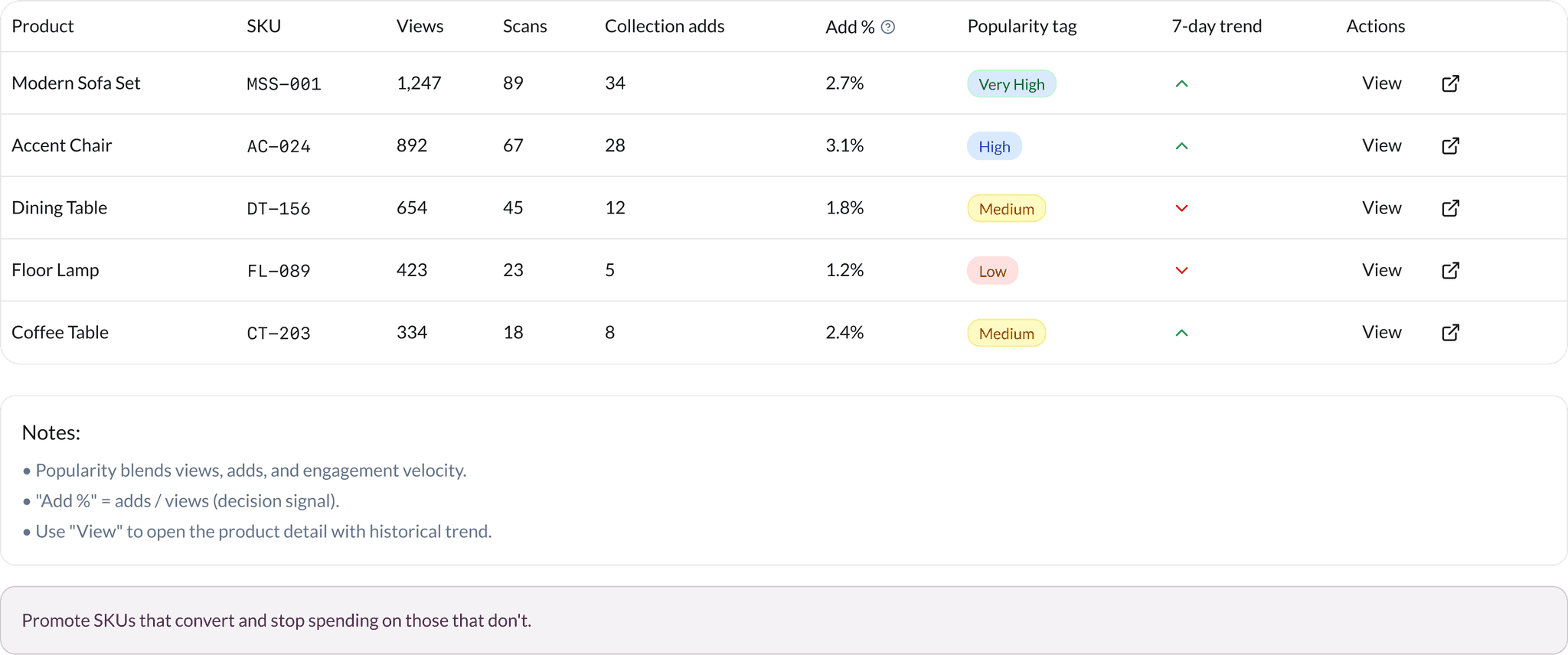

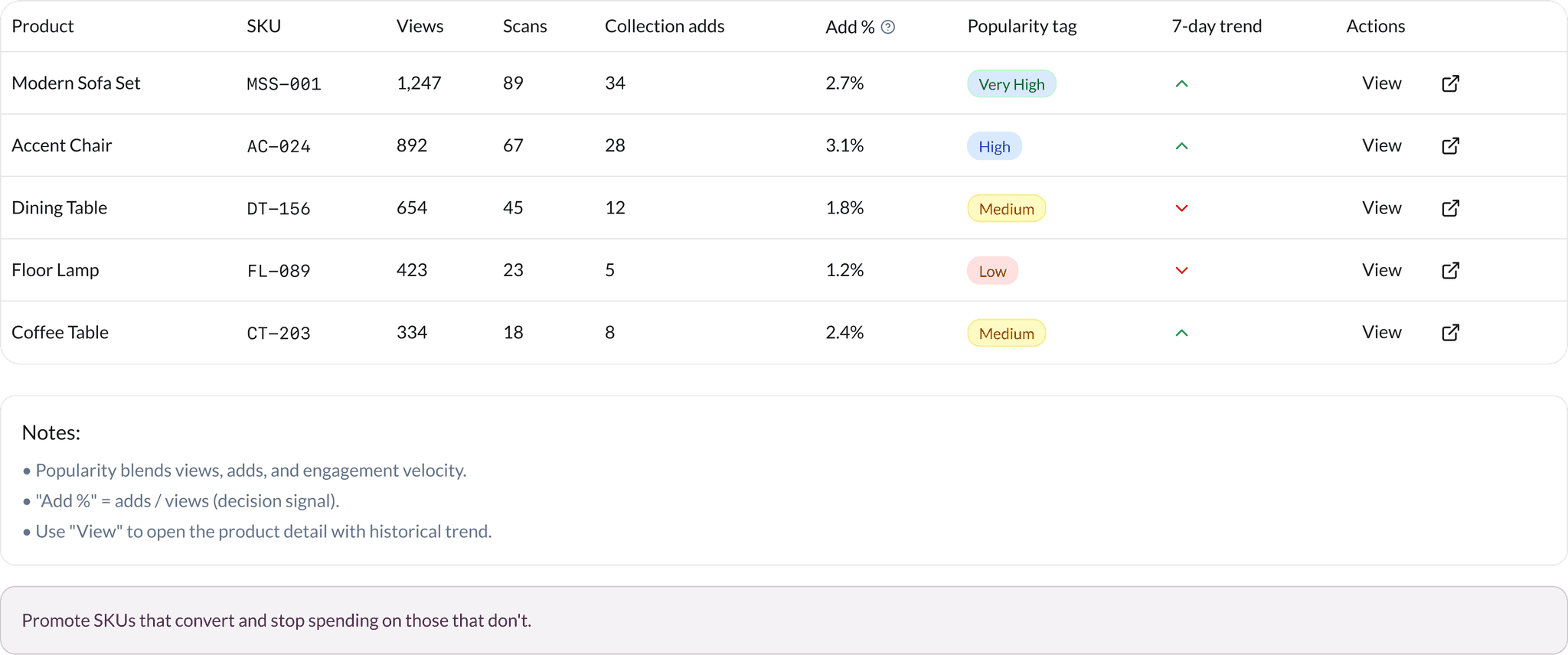

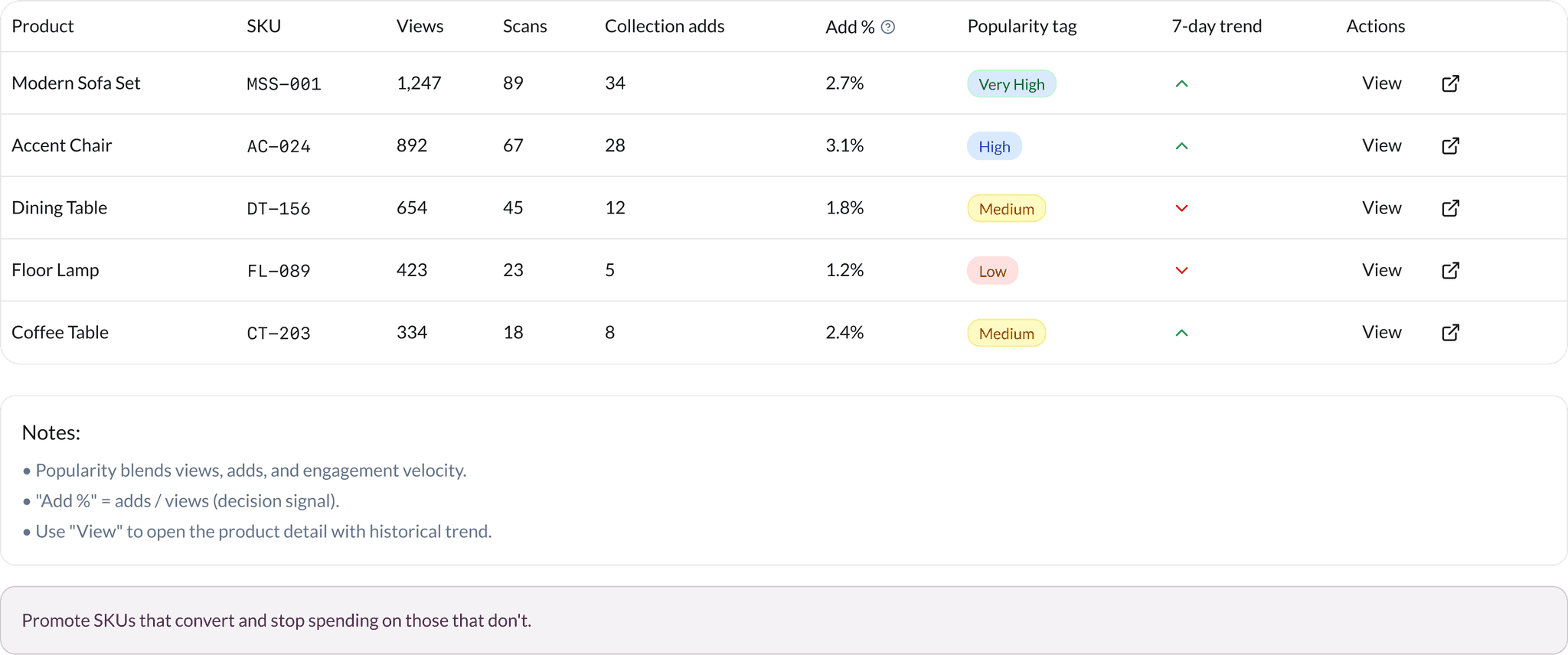

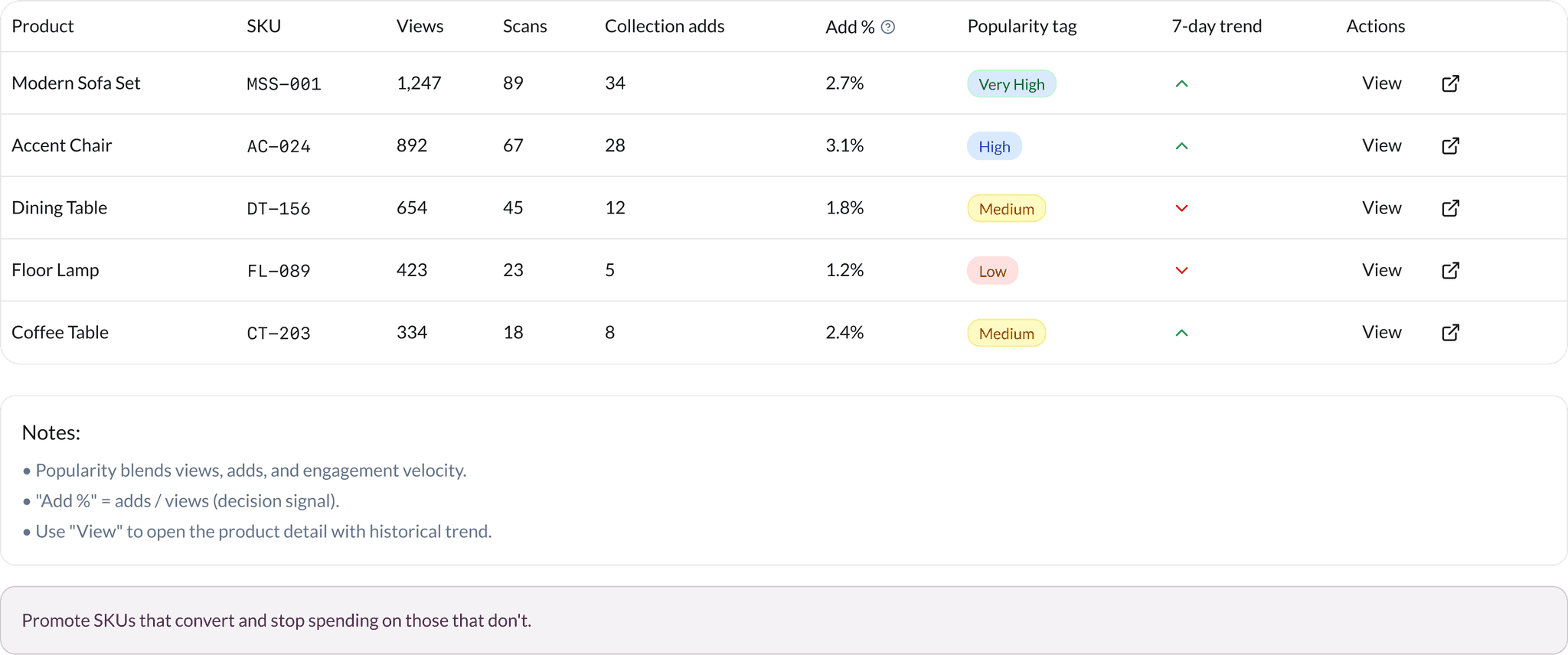

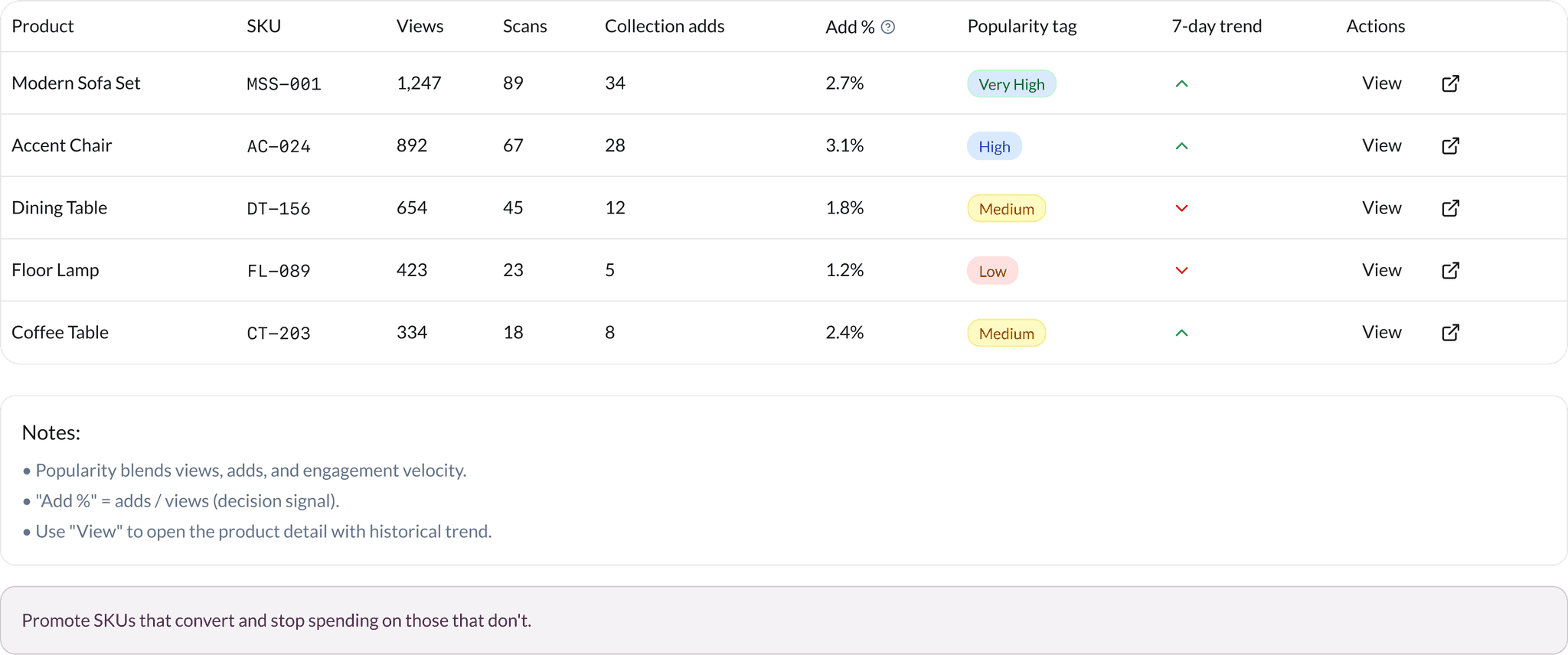

Product popularity

Ranked SKUs with trends so you can push winners and fix—or drop—laggards.

Meeting conversion

34%

Appointments that turn into opportunities

Live activity feed

Every interaction in one stream: product views, QR scans, and "add to collection" events across all end-users.

Product popularity

Ranked SKUs with trends so you can push winners and fix—or drop—laggards.

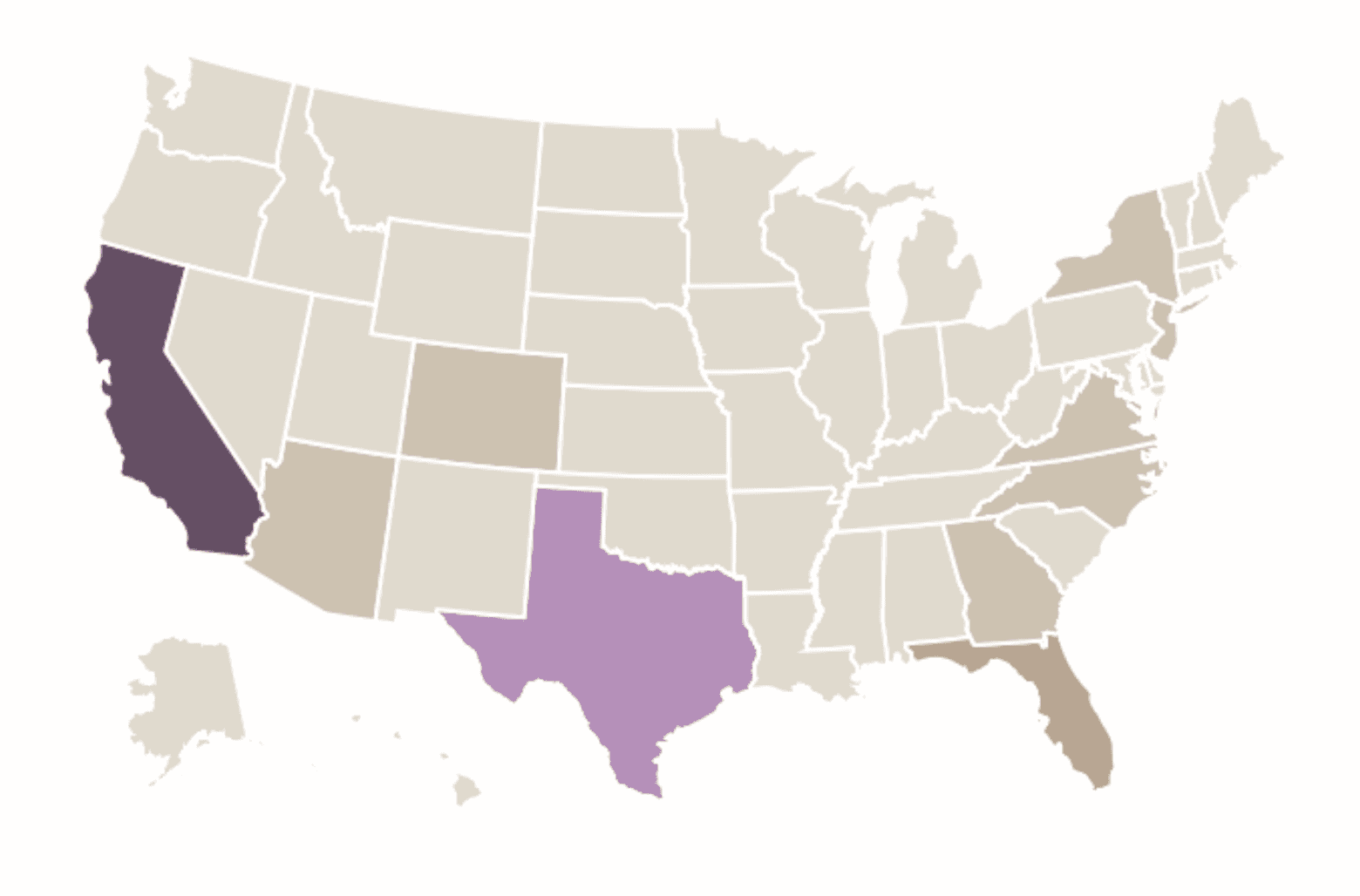

Regional engagement

See where demand is building—state and territory heat with top regions ranked.

Engagement Heat Map

Higher engagement

Lower engagement

Top Regions

Region

Views

Scans

Collection adds

Total

interactions

California

2,847

234

89

3,170

New York

2,156

198

67

2,421

Texas

1,932

167

54

2,153

Florida

1,654

134

43

1,831

Virginia

1,432

123

38

1,593

Pennsylvania

1,232

103

28

1,363

Colorado

1,114

59

58

1,231

Arizona

1,109

50

38

1,197

Callout: Compare date ranges to see Market week spikes vs. baseline.

ROI: Aim appointments, inventory, and rep time where buyers are actually active.

Rep & territory performance

Who's creating pipeline—and where to coach.

By territory

By rep

Territory

Views

Scans

Collection adds

Total interactions

Meetings

Opportunities

Win rate

Actions

West Coast

4,279

357

127

4,763

23

12

52%

Northeast

3,421

287

98

3,806

19

14

74%

Southeast

2,876

234

76

3,186

16

8

50%

Midwest

2,134

178

54

2,366

12

9

75%

ROI: Route hot accounts to top performers and coach the rest to lift close rates.

More ways to get paid

More ways to get paid

Market vs. year-round

Compare Market week spikes with always-on sourcing.

Prove pipeline outside show dates by exhibiting to buyers year-round.

Exports & schedules

Email/PDF snapshots and CSV exports.

Fewer manual reports; more time selling.

Accounts overview

Top accounts by interaction and repeat behavior.

Focus on buyers with the highest probability to order again.

Attribution & UTM integrity

See which sources and campaigns actually convert.

Cut dead channels; defend spend that drives orders.

Schedule Email

Export CSV

Ready to turn these insights into orders?

Book demo

Get vendor kit

Ready to turn these insights into orders?

Book demo

Get vendor kit

Know what pays. Double down on it.

Your analytics tie Market activity to real revenue—live feed, product popularity, regional heat, and rep

territory performance.

ROI banner: Insights exist to pay for the subscription—cut what doesn't convert and scale what does.

Cut what doesn't convert and scale what does.

Rep & territory performance

Who's creating pipeline—and where to coach.

By territory

By rep

Territory

Views

Scans

Collection adds

Total interactions

Meetings

Opportunities

Win rate

Actions

West Coast

4,279

357

127

4,763

23

12

52%

Northeast

3,421

287

98

3,806

19

14

74%

Southeast

2,876

234

76

3,186

16

8

50%

Midwest

2,134

178

54

2,366

12

9

75%

Route hot accounts to top performers and coach the rest to lift close rates.

More ways to get paid

Market vs. year-round

Compare Market week spikes with always-on sourcing.

Prove pipeline outside show dates by exhibiting to buyers year-round.

Exports & schedules

Email/PDF snapshots and CSV exports.

Fewer manual reports; more time selling.

Accounts overview

Top accounts by interaction and repeat behavior.

Focus on buyers with the highest probability to order again.

Attribution & UTM integrity

See which sources and campaigns actually convert.

Cut dead channels; defend spend that drives orders.

Schedule Email

Export CSV

Ready to turn these insights into orders?

Book demo

Get vendor kit